Paul B Insurance - Questions

The insurance coverage business will review this report very closely when investigating your insurance claim. Take notes that cover all the details of the crash.

The moment the crash occurred. The names and get in touch with details of witnesses to the collision. The weather as well as roadway conditions at the time of the mishap. The name and also badge number of the police officer who comes to the accident scene. Sue with your insurance policy firm as quickly as feasible after the accident.

This individual will: Take a look at as well as take photos of the damage to your cars and truck. See the mishap scene. Interview you, the various other chauffeur or motorists entailed, and witnesses to the collision. Review the authorities report about the accident. Check out hospital costs, clinical documents, and also proof of lost salaries related to the accident with your permission.

3 Easy Facts About Paul B Insurance Shown

Identify mistake in the mishap. Pursue the other vehicle driver's insurance firm if he or she was at mistake.

Recognizing exactly how car insurance coverage works should be a concern for any brand-new motorist. Talk with your insurance firm if you currently have coverage yet wish to discover even more about your plan. An agent can help you pick automobile insurance coverage that safeguards your individual properties from loss in a car accident.

Consequently, term life insurance coverage tends to be a lot more affordable than long-term life insurance, with a set price that lasts for the entire term. As the original term draws to a close, you might have three options for ongoing protection: Let the plan expire and also replace it with a brand-new policy Restore the policy for an additional term at a modified rate Transform your term life insurance policy to entire life insurance policy Not all term life insurance policy plans are renewable or exchangeable.

The Main Principles Of Paul B Insurance

The payment goes to the lender instead of any type of survivors to settle the continuing to be equilibrium. Because debt life insurance policy is so targeted, it is much easier to qualify for than other options. As long as the insurance policy holder pays the premiums, irreversible life insurance coverage never ever runs out. Due to the fact that it covers the insured's entire life, premiums are more than a term life insurance policy plan.

Review a lot more about the different kinds of long-term life insurance policy below. While the policyholder is still alive, he or she can draw on the policy's cash money value.

8 Easy Facts About Paul B Insurance Explained

The essential difference is the policyholder's capacity to spend the policy's cash money worth. Depending upon the performance of that investment, find more information the money value might climb or fall over time. Throughout all this, the policyholder has to maintain a high sufficient money worth to cover any type of plan charges. Otherwise, the plan will certainly gap.

On the flip side, the earnings from a high-return investment might cover some or every one of the premium prices. go to website An additional benefit is that, unlike with most policies, the money value of a variable policy can be included in the survivor benefit. Final expenditure life insurance policy, also called funeral or funeral insurance policy, is implied to cover expenses that will be charged to the insurance holder's family members or estate.

It is a particularly eye-catching option if one party has health and wellness issues that make an individual plan unaffordable. However, it is much less typical than other sorts of long-term life insurance policy.

The Ultimate Guide To Paul B Insurance

A few points you should understand concerning travel insurance coverage: Advantages vary by plan. Travel insurance policy can not cover every feasible circumstance.

Without traveling insurance, you 'd lose the money you spent on your getaway., which implies you can be reimbursed for your pre paid, nonrefundable trip prices.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

What Does Paul B Insurance Do?

You can contrast the expenses as well as advantages of each. It includes trip termination, journey disruption as well as trip delay benefits.

This cost effective strategy consists of emergency situation clinical as well as emergency situation transport benefits, as well as other post-departure benefits, but journey cancellation/interruption. If you click here for info desire the reassurance of carrying substantial traveling insurance policy benefits, the very best fit may be the One, Journey Prime Plan. This strategy additionally covers children 17 as well as under free of cost when taking a trip with a parent or grandparent.

It offers you economical defense for a complete year of traveling, including advantages for journey cancellation and disturbance; emergency medical care; lost/stolen or postponed baggage; and Rental Auto Theft & Damages defense (readily available to citizens of many states). The ideal time to buy traveling insurance policy is immediately after you've completed your traveling setups.

The Basic Principles Of Paul B Insurance

You have to get your strategy within 14 days of making your preliminary journey deposit in order to be eligible for the pre-existing clinical problem benefit (not available on all plans). If you're not entirely pleased with your strategy, you have 15 days (or more, depending on your state of home) to request a reimbursement, given you haven't begun your journey or initiated a case.

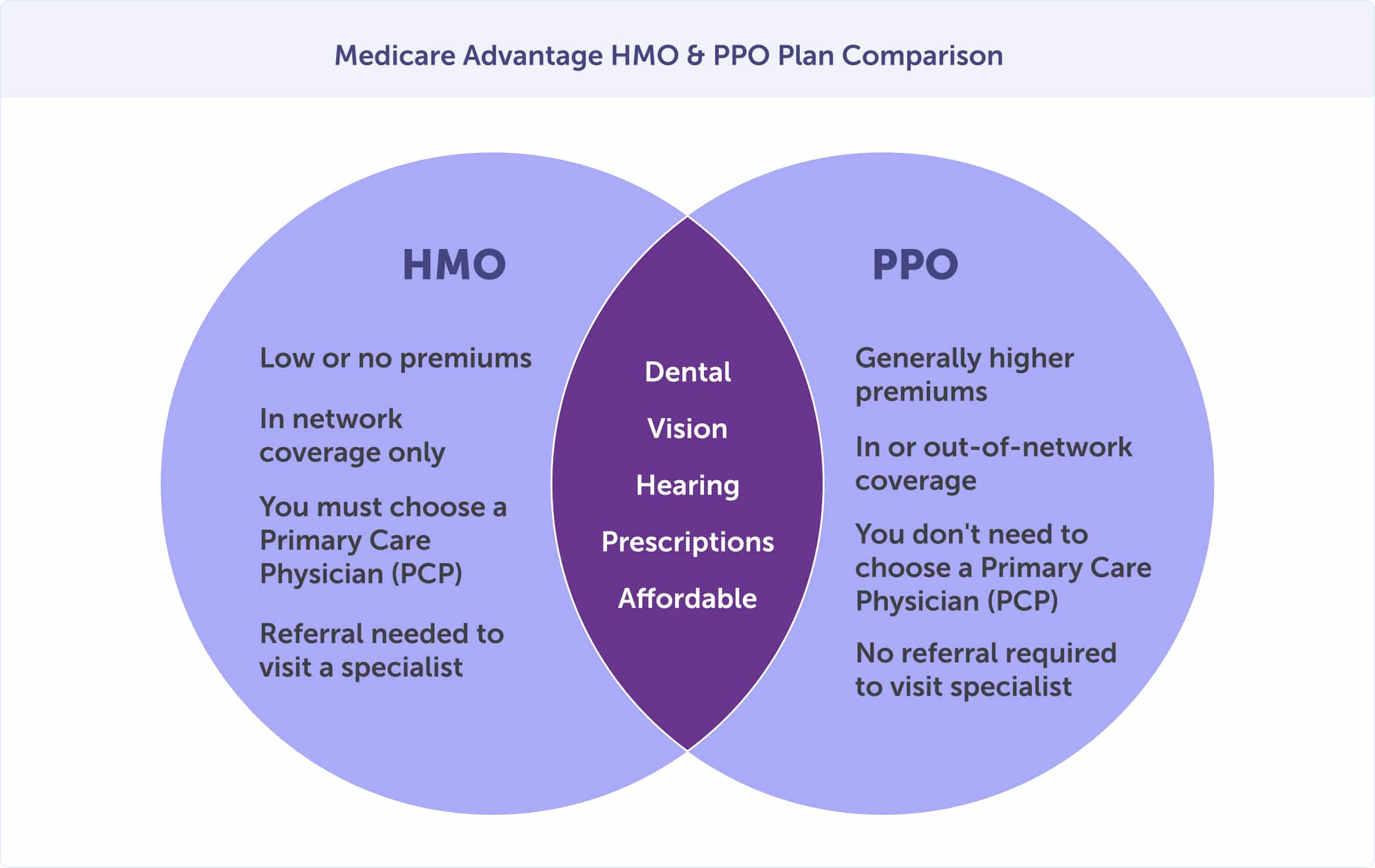

Strategies might offer some added benefits that Original Medicare does not cover like vision, hearing, and dental solutions. You sign up with a strategy provided by Medicare-approved personal companies that follow regulations set by Medicare. Each plan can have different guidelines for exactly how you obtain solutions, like needing referrals to see a professional.